SNT모티브

Stock Information

SNT Motiv that creates the future with trust and technology

Stock Information

- Home

- IR

- Stock Information

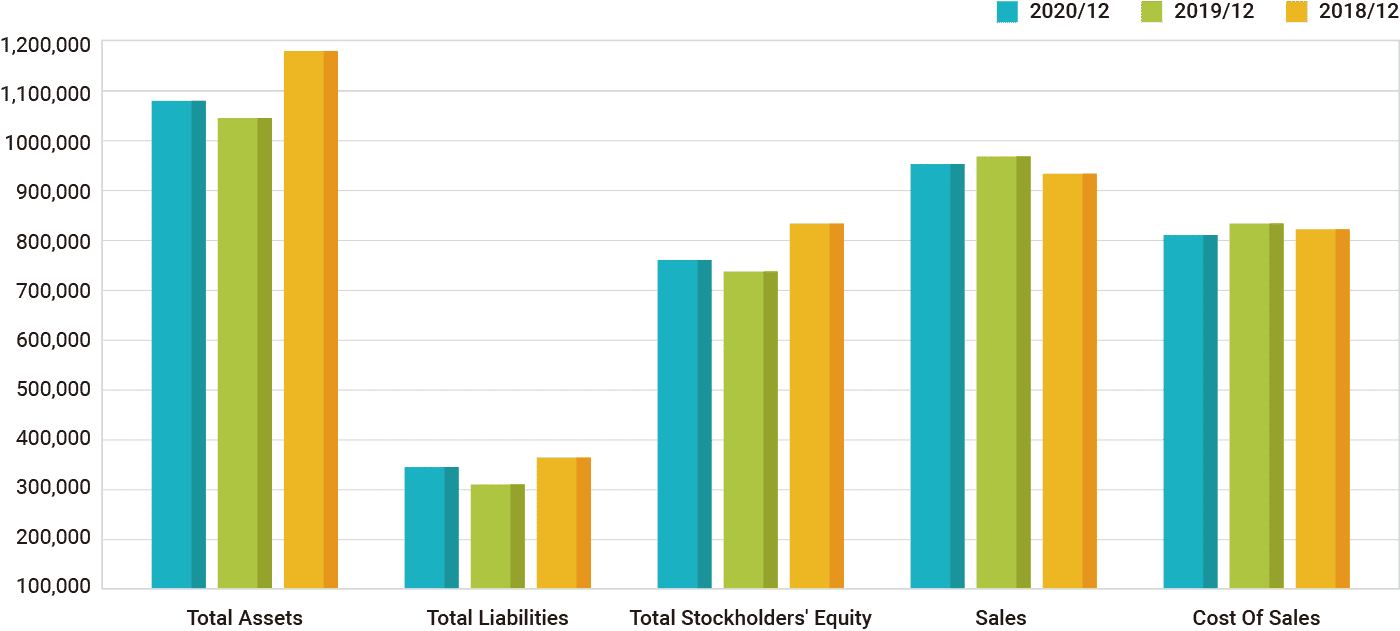

| Item | 2020/12 (Closing Account) |

2019/12 (Closing Account) |

2018/12 (Closing Account) |

|

|---|---|---|---|---|

| Balance Sheet | Total Assets (mil.KRW) | 1,092,927 | 1,038,905 | 1,196,519 |

| Total Liabilities (mil.KRW) | 332,203 | 302,937 | 371,711 | |

| Total Stockholders' Equity (mil.KRW) | 760,724 | 35,968 | 824,808 | |

| Income Statement | Sales (NET) (mil.KRW) | 940,746 | 976,274 | 918,910 |

| Cost Of Sales (mil.KRW) | 804,080 | 823,009 | 807,312 | |

| Operating Profit (mil.KRW) | 89,382 | 89,215 | 58,174 | |

| Net Income (mil.KRW) | 54,441 | 78,667 | 55,376 | |